Terms and Conditions Governing the mint Finance Reward Programme ('Reward Programme')

Last updated: December 2024

1. The Reward Programme allows mint Wallet Account Holders ('Account Holders') to receive reward (Reward) when opening mint Wallet Account ('Welcome Benefit'), and earn Rebate the combined balance on their Wallet Account and Card Account, and allows mint Curiosity Debit Card Holders ('Cardholders') to earn cashback ('Cashback') on their card spendings on the mint Curiosity Debit Card.

2. Welcome Benefit means the Reward granted directly to a User upon opening a mint Wallet Account. This Reward is credited in the form of monetary value and is subject to the following conditions:

- It cannot be directly withdrawn as cash;

- It is exclusively applicable for spending with the mint Debit Card (e.g., purchases, payments);

- It must be used within the validity period specified by mint Finance (if any).

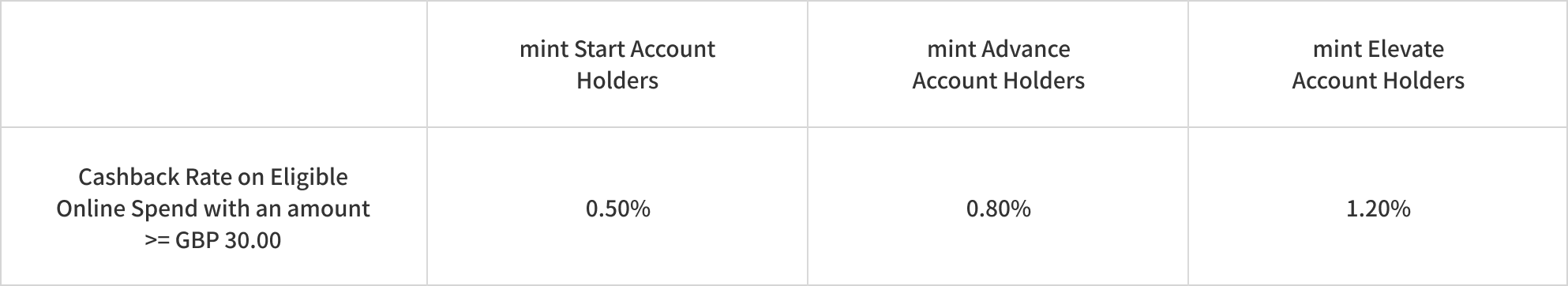

3. The earn rate of Cashback and Rebate is determined by the Wallet Account Plan ('Account Plan') of the Account Holders. Certain Account Plans bear a monthly fee to Account Holders. Please see the mint Wallet Account Terms of Use for more details.

4. The monthly fee is charged to the Wallet Account of Account Holders on the first calendar day of each calendar month. Please see the mint Wallet Account Terms of Use for more details.

5. If on a certain day within the month the Account Holder opts to upgrade to a higher tier Account Plan, the Account Holder may enjoy the earn rate of Cashback and Rebate of that higher tier Account Plan for this entire month. Previously estimated Cashback and Rebate will be recomputed. The Account Holder must be charged the monthly fee difference. Please see the mint Wallet Account Terms of Use for more details.

6. If on a certain day within the month the Account Holder opts to downgrade to a lower tier Account Plan, the Account Holder may enjoy the earn rate of Cashback and Rebate of the higher tier Account Plan until the end of this month. Starting from the next calendar month, the Account Holder may be charged the monthly fee of the lower tier Account Plan and start to enjoy the earn rate of Cashback and Rebate of the lower tier Account Plan moving forward. Please see the mint Wallet Account Terms of Use for more details.

7. The Reward Programme allows Cardholders to earn the following cashback based on their mint Wallet Account Plan in each calendar month:

8. There is no maximum cashback that a Card Account can earn within any calendar month.

9. There is no minimum monthly spend (spend in the same calendar month) for Cardholders to charge to qualify for the Cashback.

10. To qualify for being included in the Cashback calculation, the transaction amount charged must be at least GBP 30.00 or or its equivalent in foreign currency equivlent foreign currency worth of retail transaction(s) ('Minimum Transaction Amount Requirement').

11. Eligible Online Spend refers to retail transaction(s) for goods and services made via the Internet and processed by the respective merchants/acquirers as a card-not-present transaction through Mastercard networks, charged to the Card and excludes the following:

- Any payment for educational institutions (such as application fees, tuition fees, etc.) and payments to rental platforms (such as rent fees, apartment fees);

- Payments to financial institutions (including but not limited to banks, online trading platforms and brokerages);

- Payments to professional service providers (including but not limited to accounting, auditing, bookkeeping services, advertising services, funeral services, legal services and attorneys, and Pay+Earn);

- Any top-up or payment of funds to payment service providers, prepaid cards, gift cards, any prepaid accounts or purchase of prepaid cards/credits (including but not limited to Oyster Card, Apple Gift Card, Amazon Gift Card, Paypal);

- Any betting transaction (including but not limited to levy payments to local casinos, lottery tickets, casino gaming chips, off-track betting and wagers);

- Any transaction related to cryptocurrencies;

- Fund transfer, monthly or annual fees, all fees charged by mint Finance, miscellaneous charges imposed by mint Finance (unless otherwise stated in writing by mint Finance);

- Any transaction subsequently cancelled, voided, refunded, or reversed for any reason;

- Any transaction subsequently adjusted to an amount below GBP 30.00 for any reason; and

- Any other transaction determined by mint Finance from time to time.

12. mint Finance determines an online transaction based on system indicators. These indicators are decided by the merchant, their bank, and Mastercard, and passed to SUNRATE and mint Finance when the transaction is posted to the Card.

13. The Reward Programme enables Account Holders to earn rebates ('Rebate') based on the combined balance maintained in their Wallet Account, calculated according to the qualified balance period and applicable Reward Programme(s) they participate in from time to time.

14. Cashback set out in Clause 6 and/or Rebate set out in Clause 12 will be awarded to the Cardholder/Account Holder's Wallet Account (that is of good standing) within the following calendar month.

15. Cashback and/or Rebate will not be awarded to a Cardholder/Account Holder's Wallet Account, if their Card Account and/or Wallet Account is delinquent, voluntarily, or involuntarily closed, terminated, or suspended for any reason whatsoever before the Cashback and/or Rebate is awarded.

16. Cashback and/or Rebate awarded will be reflected in the monthly Wallet Account statement.

17. Any Cashback awarded by mint Finance in respect of Refunded/Adjusted Transactions will be deducted from the linked Wallet Account accordingly.

18. Cashback is computed when the transaction is finalized and posted into the Card Account. The applied Cashback rate is determined by the Wallet Account Plan of the Cardholder on the date when the transaction is finalized and posted.

19. Cashback and Rebate are computed to the nearest two decimal places per transaction.

20. The main business activity and any transaction performed at a merchant are classified under a Merchant Category Code ('MCC') assigned by the association scheme and determined by the merchant and the merchant's acquiring bank. The main business activity and the assigned MCC of a merchant is not determined by mint Finance or SUNRATE. If any transaction is not classified under a relevant MCC, such transactions will not be considered as part of the Minimum Transaction Amount Requirement or be eligible to earn Cashback.

21. mint Finance and SUNRATE shall not be responsible for any failure of delay in posting of sales transactions which may result in any customer being omitted from enjoying the Cashback benefits.

22. mint Finance and SUNRATE reserve the right at any time without giving any reason or notice to you to deduct, withdraw, or cancel any Cashback and/or Rebate awarded to you without liability. You will not be entitled to any payment or compensation whatsoever in respect of such deduction, withdrawal, or cancellation.

23. Any decisions of mint Finance and SUNRATE on all matters relating to the Reward Programme shall be final. No correspondence or claims will be entertained.

24. In the event of any inconsistency between these Terms and Conditions and any customer service statments/communications, website/in-app posts, brochure, and marketing/promotional material relating to mint Debit Card or mint Wallet Account, these Terms and Conditions shall prevail.

25. mint Finance and SUNRATE may vary these Terms and Conditions or suspend or terminate the Reward Programme without any notice or liability to any party.

26. mint Finance and SUNRATE reserves the right to adjust, modify, or discontinue the terms, conditions, and reward rates (including percentages, amounts, or eligibility criteria) of the Reward Programme at any time, with 30 days' prior notice on the website/in-app posts, at their sole discretion. Such adjustments apply to all Users, including existing and newly registered Account Holders/Cardholders.

27. If a Cardholder's Account remains inactive for 90 consecutive days (i.e., no transactions conducted during this period), mint Finance and SUNRATE reserve the right to revoke any Welcome Benefit previously granted under the Reward Programme, with or without prior notice.

28. All Cardholders/Account Holders consent under the Data Protection Act 2018 (DPA 2018) of the UK to the collection, use and disclosure of their personal data by/to mint Finance and SUNRATE and such other third party as mint Finance and SUNRATE may reasonably consider necessary for the purpose of the Promotion, and confirm that they agree to be bound by the terms of the mint Finance Privacy Notice.

These terms are governed by English law and subject to the exclusive jurisdiction of English courts. For detailed fee information and current cashback rates, please refer to our Fees and Limits Schedule.